Apps helping India go cashless

From a cup of coffee to online rent pay features, demonetization has its own stories of impact on our day to day lives. But moving with a technologically advanced country online transaction of money has emerged as one of the most convenient way of sharing money from one person to another without any fear of loss. Here are few Mobile apps/online platforms that supported cashless economy principles and emerged as “Most useful app in times of Demonetization”.

BHIM (Bharat Interface for Money) is a Mobile App developed by National Payments Corporation of India (NPCI), based on Unified Payment Interface (UPI), launched by Prime Minister of India Narendra Modi to facilitate e-payments directly through bank. It was launched as part of the 2016 Indian banknote demonetisation and Cashless transaction drive, at a Digi Dhan programme. Now available in all android phones. The BHIM app is supposed to support Aadhaar-based payments, where transactions will be possible with just a fingerprint impression.

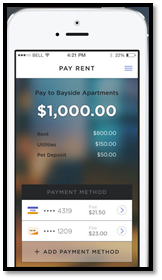

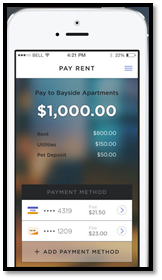

RentPay is an online innovative FinTech product of redgirraffe.com, which enables cashless rental (Residential & Commercial) transactions between landlords and tenants via CREDIT CARDS. To bring about this revolutionary system, RedGirraffe.com has been working on the FinTech part for nearly over 3 years now thereby studying every possible such model operational in the world. Once the stack was LIVE the company entered into Strategic Technology Interface Integration with all of the most prominent banks and Credit Card Companies operating within India & in the United Kingdom. With this immaculately timed move, RedGirraffe.com has become the first and only company globally to enable residential and commercial monthly rental payments to be transacted via CREDIT CARDS. Specially in the times of demonetization this feature came out as a support to several people from all generations

Paytm is India’s largest mobile commerce platform. Paytm started by offering mobile recharge and utility bill payments and today it offers a full marketplace to consumers on its mobile apps. In 2014, the company launched Paytm Wallet, which became India's largest mobile payment service platform with over 150 million wallets & 75 million android based app downloads as of November 2016. The surge in usage of the service was largely due to the demonetizaton of the 500 and 1000 rupee currency note. The application enables users to book air tickets and taxis, mobile recharge, and payment of DTH, broadband and electricity bills among others. Users can also pay for fuel at Indian Oil Petrol pumps and buy movie tickets at PVR Cinemas through the wallet.

MobiKwik is a mobile wallet and online payment system where a user can store money in an online "wallet" to make mobile and DTH recharge, pay utility bills, and shop at listed merchants. The MobiKwik wallet has to be loaded with money once before it can be used across functions. MobiKwik provides users the option to add money using their debit or credit card, net banking, and ‘cash pay’, a doorstep cash collection service. MobiKwik wallet is a semi closed wallet authorized by Reserve Bank of India. In the recent years they have done tie-up with various e-commerce merchants and On November 28, 2016 MobiKwik launched its MobiKwik Lite app aimed at users in poor connectivity regions. It came out as a good success in the times of demonetization and helped people from every generation and every locality.

PayU India is the flagship company of Naspers group which is a $25 Billion internet and media conglomerate listed on London and Johannesburg stock exchanges respectively. PayU provides state-of-the-art payment gateway solutions to online businesses through its cutting-edge and award winning technology. PayU money is a wallet from PayU. You can use your cards or savings account to find your wallet and use that when you are transacting online. You don't need to enter your card details etc everytime. PayU Money is a free product and is for start-up organisations. So that merchants with saving account can get payment gateway for their site. Specially it helped people and various organisations a lot at times of demonetization.

Ola is an Indian online transportation network company. Ola was founded as an online cab aggregator in Mumbai, but is now based in Bangalore. As of September 2015, Ola was valued at $5 billion. They keep updating their business with various features like Ola auto, TFS cabs etc. Ola provides different types of cab service ranging from economic to luxury travel. The cabs are reserved through a mobile app. This cab service supports both cash and cashless payment options with Ola money. It claims to clock an average of more than 150,000 bookings per day and commands 60 percent of the market share in India. At times of demonetization Ola cabs came out as a saviour to all people who wanted to travel cashless.

From a cup of coffee to online rent pay features, demonetization has its own stories of impact on our day to day lives. But moving with a technologically advanced country online transaction of money has emerged as one of the most convenient way of sharing money from one person to another without any fear of loss. Here are few Mobile apps/online platforms that supported cashless economy principles and emerged as “Most useful app in times of Demonetization”.

Bhim–

RentPay –

Paytm- –

Mobikwik –

PayU Money –