The survey was conducted for the period of Oct-Dec 2016

Magicbricks, India’s No1 online real estate site releases PropIndex for the period October – December 2016. Magicbricks PropIndex is a tool which empowers property seekers and investors with detailed information on the movement of residential apartment prices and supply of properties in India. Though the real estate market in India saw an initial dip after the demonetisation drive, the market now is finally stabilizing and catching back with its pre-demonetisation phase. The steep decline in pricesduring this time was restricted to certain geographies and budgets. In cities like Hyderabad, Greater Noida, Thane, Bangalore and Navi Mumbai, the prices went up by 0.5-2.5%, while places like Noida, Gurgaon and Ghaziabad experienced a price drop and prices were stagnantin the remaining six cities.

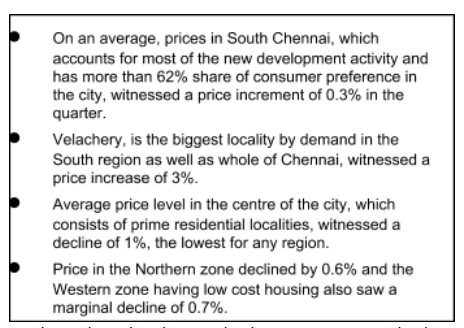

The City Index moved up by 0.4% this quarter, which was 0.7% increase in the previous quarter. The Oct-Dec 2016 quarter had more localities with price decline than price increment. Around 48% localities witnessed price increase averaging 2.1%, while the balance 52% witnessed an average price drop of 2%. Price movement across most budget segments was positive with the over Rs 11,000 per sqft and the Rs 5,000-6,000 per sqft price segments witnessing an increment of 0.9% and 0.6%, respectively. The Rs 3,000-4,000 per sqft and Rs 4,000-5,000 per sqft price segments witnessed a price drop of around 0.6% and 0.4%, respectively in the Oct-Dec 2016 quarter. The two budget segments hold around 45% of the city's consumer demand and 61% of the supply.

Mr. SudhirPai, CEO Magicbricks says, “Our Data sciences and analytics team, enables us to give un-opinionated views about the real estate market trends. Insights from our recent PropIndex report show that while the average price of Ready-to-Move properties declined in 8 out of 14 cities this quarter, the impact was majorly seen in higher budget segments. What is interesting to note is that pan-India, Ready-to-Move properties commanded a 7% premium over Under Construction properties which in future will keep the prices of the new launches under check”

Analysis across 41 localities shows that on an average, Under Construction (UC) properties were 14% more expensive than the Ready-to-Move-in properties (RM). The average difference is the same as the last quarter. The weighted average price of RM properties was Rs 5,902 per sqft, and for UC properties it was Rs 6,862 per sqftThe average difference remained almost the same for the last eight quarters. The weighted average price of RM properties was Rs 5,902 per sqft, the same for UC properties was Rs 6,862 per sq ft.

Overall, the National Property Index has remained stagnant at the same level as the last quarter, with Ready to move properties witnessing a price fall of 0.4% and Under-Construction properties, a price rise by 0.8%. Considering the overall quarterly impact, south was the only region that experienced a price hike, while north on the other hand watched the prices fall. This year, the real estate sector saw both, the general prices dip and the RM Prices suffer due to the pressure of demonetization. At an average, western and northern India has done better than other regions with 9% price increment in their cities.

Methodology:

Magicbricks, the largest repository of residential property listings, brings you the trusted Indian Apartment Price Index in a new and easy to use format. Magicbricks publishes the quarter-on-quarter inflation and deflation trends of the residential real estate prices in India. It collects real estate demandsupply data on a daily basis for more than 100 cities in India, of which, the fourteen top cities are selected for computing the National Property Price Index. Through this, we provide you with data that gives consumers with realistic benchmarks to assess true property pricing

What is Prop Index?

Magicbricks PropIndex is a tool which empowers property seekers and investors with detailed information on the movement of residential apartment prices in India. No credible property index can be a function of direct values as the changes are governed by multiple factors. The Index for a city reflects the price movement across prominent localities. These localities have been chosen using the twin criterion of share in overall consumer searches in the city as well as share of actively traded properties. The weight assigned to each locality is its share of consumer searches in the city. This makes for a comprehensive Index which covers localities with high consumer preference as well as high number of actively traded properties in the secondary market.

About Magicbricks:

Magicbricks.com is India’s No.1 property site. With monthly traffic exceeding 12 million visits and with an active base of over 14 lakh+ property listings, Magicbricks provides the largest platform for buyers and sellers of property to connect with each other in a clear, transparent manner. With this in mind, Magicbricks has innovated several product features, content and research services, which have helped us, build the largest audience pool.