Launches 'Mission FINFIT' in collaboration with Fisdom, to offer investment solutions based on a digital platform

1 February 2017 Chennai:-Lakshmi Vilas Bank, one of the fastest growing private sector banks in India has tied up with Fisdom, a fin-tech startup to launch a financial planning platform called Mission FINFIT for personal wealth management services based on Robo advisory. With this, the bank will offer an online wealth management platform, to help the bank's customer to plan their finances in an easy and simple approach.

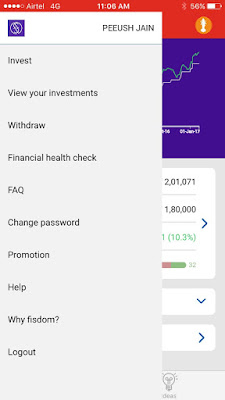

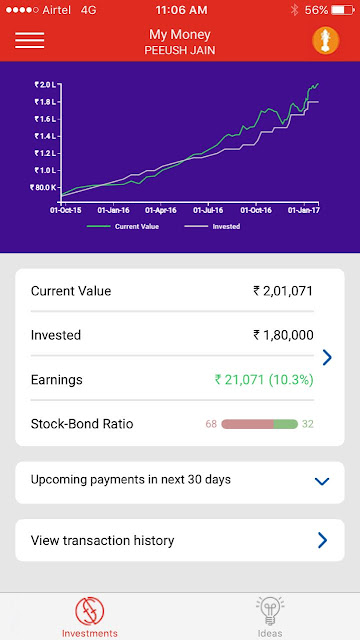

LVB is lining up an array of services as a part of its digital focus. As a part of this, an association with Fisdom will help the customers plan their finances in a better way. This application will advise the customer to plan their finances as per their set goals. It will include services like getting the KYC done, investing money in various platforms, viewing the account summary, withdrawing the invested money and many more. This would be a step ahead to become a one-stop shop for all the banking products, and offering the customers an experience advisory to attain its investment goals.

With the focus on digital banking theme, Lakshmi Vilas Bank is offering various Banking services as a part of its retail banking portfolio and has recently launched a LVB Mobile Banking app. The app is a touch point to the digital savvy customers and allows customers to transact from their mobile phones without visiting the branch, taking banking to their finger tips. The bank is also planning to launch a mobile wallet in the coming days.

Commenting on the association, Mr. Parthasarathi Mukherjee, MD & CEO, Lakshmi Vilas Bank said, "The Mission FINFIT has been launched to provide wealth management services exclusively to Lakshmi Vilas Bank’s customers, in order to encourage them to invest smarter. With this, we are supporting digital payment channels such as mobile app, mobile wallet etc, which are gaining momentum. This association will be part of our broader focus on diversifying and offering products and services in the banking and financial space.

Supporting his statement, Mr. AJ Vidya Sagar, President Retail Banking, Lakshmi Vilas Bank said, “Going cash less and digital is the way to the future and hence our bank has introduced this online platform to our retail customers. We recently launched our mobile app which has been a huge success and with this collaboration with Fisdom, the bank will enhance its bouquet of banking products and services offered to its customer base. In this partnership, Fisdom will be our product and service delivery partner”

Fisdom is a Bangalore based startup that uses cutting edge technology to solve inherent issues with financial investments by making investing easy to understand, quick and highly accessible through a mobile and web app.

Subramanya SV, CEO and Cofounder, Fisdonstated “We are delighted to partner with Lakshmi Vilas Bank to offer Mission FINFIT to more than 30 lakh customers of the bank across the country. While we are a startup, the accreditation to be partners with Lakshmi Vilas Bank is a fantastic achievement. This will help us offer digital and smart investment options and advisory to a very loyal base of customers”.

About Lakshmi Vilas Bank

Lakshmi Vilas Bank was founded in 1926 by a group of seven progressive businessmen of Karur under the leadership of Shri V.S.N. Ramalinga Chettiar. With a customer base of more than 30 lacs, the bank’s operations are spread over a network of 467 branches and 925 ATMs a with pan India presence.

About Fisdom

Fisdom, is an online wealth manager that simplifies all aspects of investing for financially non-savvy customers - onboarding, advisory, transaction, active management - all delivered digitally and through algorithms directly on one’s smartphone. Fisdom is available on the web, Google Play and App Store. Finwizard Technology Pvt Ltd which owns fisdom was founded by the dynamic team of Subramanya SV, Ramganesh Iyer, and Anand Dalmiya.