- 19 New Brands Enter The Country

- Retail Gets Over USD 0.7 Billion Of Investment In 2016

New Delhi, January 24, 2017: CBRE South Asia Pvt. Ltd, India’s leading Real Estate Consulting firm, today announced the findings of its latest India Retail MarketView – H2, 2016 report. According to the report, the Delhi NCR market continued to be the preferred location for domestic and international retailers during the year, with close to15 new brands entering the country by using Delhi-NCR as the entry point. International brands such as Kiko Milano, Justice, and Armani Exchange opened their first stores in India while Massimo Dutti expanded operations. During the year, close to 1.5 million sq.ft. of supply entered the market; with the second half witnessing the commencement of operations by a key retail destination – Worldmark in Aerocity. Majority of the demand was driven by the fashion retail and F&B segment.

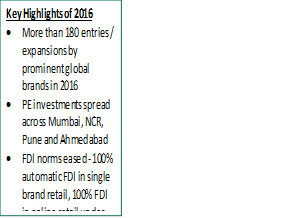

India’s retail segment witnessed more than USD 0.7 billion of investment by PE Firms/wealth funds and saw the entry of more 19 new global brands into the country in 2016. Private equity investments into the segment are expected to increase by as much as 20% in 2017, signaling that the overall market dynamics for the segment continue to be positive. During the second half of 2016, the seven key cities across the country witnessed the addition of almost 2 mn sq.ft. of supply, bringing the annual supply to 3.4 mn. Sq.ft, a marginal decline from the 3.6 mn sq.ft. of organized supply in 2015 (5% y-o-y dip).

According to CBRE, in 2016, majority of the supply that entered the market was concentrated in the National Capital Region (NCR), Bangalore and Mumbai. Global retailers expanded their portfolio with multiple store-openings; international apparel and domestic F&B players dominated demand.

Rental trends varied across key high streets and malls during the year. While some micro-markets witnessed stable rentals, other saw varying levels of rental increments. The upward movement of rentals in these select micro-markets was due to constrained availability of retail space, amidst a scenario of robust demand.

The year 2016 was of significant importance for the real estate (RE) sector, as comprehensive measures from a legislative standpoint were introduced with a view to improve transparency and accountability; thereby spurring investment and end-user activity in the sector. Measures such as the relaxation of FDI norms in single-brand retail, e-commerce, and food products manufactured/produced in India; coupled with the expected easing in retail loan rates are likely to positively impact retailer entry into India and demand for consumer durables respectively.

Commenting on the findings of the report, Mr. Anshuman Magazine, Chairman, India & South East Asia, CBRE said, “In the year 2016, the Indian economy saw quite a few legislations and policies being cleared which will have a positive impact on the retail real estate segment in the long run. The increased transparency as a result of these policies will lead to increased consumer and investor confidence. Another interesting trend that emerged last year was the increased interest of private equity players in retail malls. Several investment deals were reported during the year both in Tier I and Tier II cities by established players which is indicative of this positive sentiment.

Vivek Kaul, Head, Retail Services, India for CBRE South Asia Pvt. Ltd. said, “India’s retail real estate market is maturing at a steady pace. Key cities and retail developments continue to be on the radar of international developers. Institutional investments in the retail real-estate sector are expected to touch a new high in 2017.

H2, 2016 – city highlights

- Mumbai

- Strong demand for retail space was observed across high-streets as well as prominent mall developments

- Leasing activity was driven by domestic F&B operators and foreign retailers across various segments.

- Bangalore

o Bangalore observed steady retail leasing activity across both high streets and shopping centers,

o Approximately 0.38 million sq. ft. of fresh retail supply entered the city in H2, 2016

- Hyderabad

- Retail leasing activity in Hyderabad witnessed an upward momentum during the second half of 2016 driven by the apparel, entertainment, electronics and the F&B sector

- Approximately 0.2 million sq. ft. of fresh supply entered the market in H2, 2016

- The city witnessed brand entries by global retailers such as Aeropostale and domestic brewery chain Prost Micro Brewery

- High-street locations also witnessed expansion by apparel brands

- Chennai

- Retail leasing activity was strong in Chennai during the second half of 2016 with an increase in the number of store openings during second half of the year, driven by the expansion activity of domestic retailers and entry of global brands

- Pune

- Strong demand for Grade A retail space was observed across prominent mall clusters and emerging high-street locations of the city

- Due to the paucity of quality organized space in the city, bulk of the leasing activity during H2 2016 was concentrated in the Phoenix Market City Mall

- Across high-street locations, most of the store openings were observed across Viman Nagar and Baner while traditional high-street locations of JM Road and FC Road witnessed limited transaction activity

- Kolkata

- During H2 2016, Kolkata witnessed buoyant retail leasing activity with majority of the leasing being dominated by organized developments.

- Demand from the apparel and fashion segment dominated transaction activity during the review period followed by furniture brands

- The city is expected to witness fresh supply addition in coming year which is anticipated to spur retail activity

As we move into 2017, Delhi-NCR and Mumbai will continue to be the preferred points of entry for global retailers as both cities have the presence of the right target catchment as well as suitable real estate opportunities. While there is a strong supply pipeline expected in 2017, demand for organized retail space will continue to exceed the supply in most top markets. This will put an upward pressure on rentals at major high streets and investment-grade malls.