A win-win situation for all

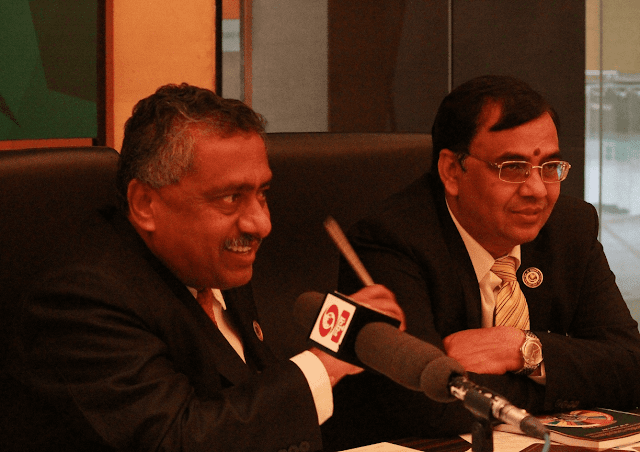

Addressing the Media here at Chennai, on the occasion of the two day Corporate Conclave, President CA. M. Devaraja Reddy, and Chairman CA G. Sekar, CPABI, ICAI spoke at length about the important role played by the Chartered Accountants fraternity in the progress of the Nation. They dwelled on the Pre-Budget Recommendations made by ICAI, Post Demonetization scenario, GST implementation and the way forward.

CA. M. Devaraja Reddy :ICAI recommends broadening Tax Base

Mr. Devaraja Reddy said, ?Starting with a handful of about 1700 members, today, the strength of Chartered Accountant fraternity has grown to over 2.54 lakh members. On the education front, the ICAI began with mere 259 students and today more than 8.50 lakh active students are a part of ICAI. The ICAI has 5 Regional offices and 161 branches all across the country. The ICAI overseas Chapters continue to spearhead ICAI work program in 28 important jurisdictions globally.?

?We have recommended to the Government to increase the individual Income Tax limit from the current Rs. 2.5 lakhs to 3.00 Lakhs. This will bring in more people to pay taxes without evading, which will also help the Govt. to garner more revenue.? He stressed that this would impact the middle class positively.

Mr. Reddy was confident that Demonetization will be a major success in the not too distant future. Even a 60 to 70% success rate will do wonders for India, he said.

Mr. G. Sekar said, ?To bring in more professionals to participate in the various programs put out by the institute, a slew of awards have been planned. Honouring exemplary work of ICAI members-in-industry for their contribution in the growth of industry and National economy, the 10th ICAI Awards 2016 will see the presentation of awards under 3 main categories- CA Business Leader, CA CFO and CA Professional Achiever and 63 subcategories.?

He added, ?Mr. O. Panneerselva, the hon?ble CM of Tamil nadu has agreed to be the Chief Guest and distribute the Awards, on 20.01.2017 (Friday), happening at Kamarajar Arangam, Chennai.

On GST:

Recently, the GST Council has fixed four-tier GST tax structure of 5%, 12%, 18%, and 28%, with zero rate for essential items and the highest for luxury and de-merits goods with additional cess. Earlier, it has increased the exemption limit of turnover from Rs 10 lakh to Rs. 20 lakh (from Rs. 5 lakh to 10 lakh for North East states) providing big relief to the small business. All these quick decisions show the intention of the Government for early implementation of the GST in the country.

ICAI has been supporting the Government by way of extending suggestions on Model GST Law, Draft rules on Registration. Payment, return and Invoice, etc., and creating awareness among our members and other stakeholders. ICAI has been approached by some State Governments asking for help in drafting their State Goods and Service ray Vo spread knowledge in the new area, ICAI has developed video lectures on aim each and every topic of US I. which are hosted on ICAI TV.

On Real Estate (Regulation and Development) Act, 2016:

The Parliament of India has passed the Real Estate (Regulation and Development) Act, 2016. It is an Act to establish the Real Estate Regulatory Authority for the regulation and promotion of real estate sector and to ensure sale of plot, apartment or building, as the case may be, or sale of real estate project, in an efficient and transparent manner. The Act also aims to protect the interest of consumers in the real estate sector and establish n adjudicating mechanism for speedy dispute redressal.

Several provisions of this Act will offer many new professional opportunities to the Chartered Accountants. The embers would need to update accordingly so as to provide virtuous professional services to their clients and oganizations in conformity to the principles enacted under the Act.

For more info, contact: Mr. Satyan Bhatt, 98400 85411, satyanbhatt@prism-india.com / Mr. Babu Ragghavan, ICAI, 75981 90071, babu.raghvan@icai.in.

Photo Caption: CA M. Devaraja Reddy, President ICAI (left) and CA G. Sekar, Chairman, CPABI