India 05 August 2016:

BFL 3 MONTH REPORT

“We have had a very challenging quarter largely because of continuing weak demand and inventory destocking in the commodities space, especially in the Oil & Gas space. This coupled with the severe downturn in the North American truck market has resulted in a weak performance in Q1. In the quarter, we have witnessed growth in the domestic CV business with performance better than the underlying market growth and also growth in passenger vehicle export business.

We continue to make steady progress in the new initiatives/sector we are focusing on to drive growth in the coming years. During the quarter, we have increased our market share in the Passenger Vehicle export business with order wins from our existing customer on the traditional products while winning our maiden global order for new products developed recently. Key drivers of future growth will be led by Passenger vehicles, Aerospace and Industrials (other than Oil & Gas) where we see good traction & growth opportunities.

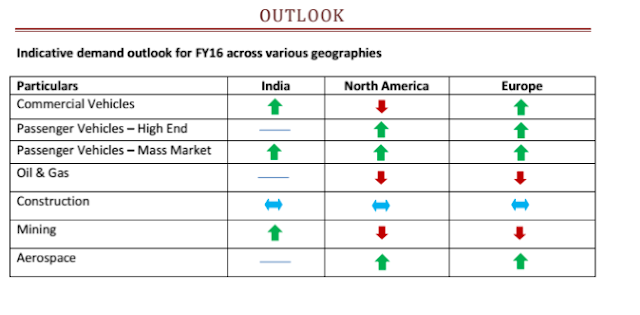

Although FY17 is a sluggish year in terms of sales development, we believe that the phase of sequential sales decline is behind us. Looking ahead in to Q2, we anticipate demand to be slightly higher compared to Q1FY17 with positive demand in India across automotive & industrial, while the challenging demand environment in the export Industrial sector will continue for some more time as the global economies adjust to the lower commodity prices.

While we navigate through a tough demand environment, our focus during FY17 is on accelerating the product development pipeline, broadening of the customer base and strong thrust on cash conservation.

B.N. Kalyani, Chairman & Managing Director.

Total Revenues declined by 19.3% in Q1 FY17 to Rs 9,571 million as compared to Q1 FY16. The domestic revenues registered a strong growth of 10.8%, but it was negated by the 40% de-growth in exports that was affected mainly by a declining US heavy truck market and the commodity related sectors in the Industrial segment.

EBITDA at Rs. 2,537 million in Q1 FY17 was affected by product mix with lower value addition and lower realization.

PBT before Exchange gain/ (loss) and Exceptional item was at Rs 1,882 million in Q1 FY17.

PAT stood at Rs 1,221 million in Q1 FY17, a decline of 37.7% as compared to Q1 FY16.

Automotive Business

The domestic automotive production volumes in this quarter witnessed growth of 6.2% as compared to the same period last year, driven by 16.4% and 4.0% growth in commercial vehicle and passenger cars respectively.

The growth in M&HCV was mainly driven by replacement demand and is expected to be supported by continuous pick up in pace of infra and construction projects, an accelerated pace of execution of the National Highways and the rise in iron ore and coal mining output. The replacement demand seems to be tapering a bit but it may be offset by pre-buying in H2, due to the pan-India BS IV implementation from April 1st, 2017.

BFL revenues from the commercial vehicle sector grew by 26% on a Y-o-Y basis, outperforming the industry growth.

The passenger vehicle market faces some issues in the form of regulatory environmental constraints and levy of additional taxes. But the growth in passenger vehicle demand is expected to continue due to higher disposable incomes and the implementation of the 7th pay commission that is expected to provide a boost to consumer spending; also rural demand is expected to return due to an improvement in the agricultural output on the back of a normal rainfall.

Industrial business

There is a gradual improvement in the economic growth environment which is expected to gain momentum in the coming months. The Government has increased its spending particularly in roads, railways, and infrastructure projects. IIP growth though muted is expected to get a fillip from a further reduction in interest rates on softening inflation, a spurt in urban spending on account of the 7th pay commission roll out and rural demand upside because of a good monsoon. The successful application of the much awaited GST will be a positive step and will help boost manufacturing.

The company’s revenue from the domestic industrial sector in Q1 FY17 grew by 13.4% on a y-o-y basis driven by demand improvement across various sectors including Wind, agriculture and government agencies. We continue to focus on various programs in the Rail, Mining, Power, Defense and Aerospace sector under the “Make in India” initiative. The portfolio of components manufactured by us using our technology, innovation and R & D capabilities have helped us made inroads in most of these sectors and we are starting to see order wins albeit on a small scale. We are confident that as the industrial activity in the country gathers pace further, we would be ready to take advantage of the opportunities on a larger scale.

Automotive Business

The revenue from the automotive segment in the export markets was a mixed bag for this quarter as

compared to the same period last year. While the passenger vehicle revenues continued to grow strongly, the commercial vehicle revenues were impacted by the lower truck volumes in North America and the consequent destocking of inventory.

In the US, the Class 8 truck production volumes are affected by low equipment utilization among large fleets, a stagnant freight demand and an increase in the truck dealer inventory levels. All OEM’s were equally impacted by the slow order intake and it is expected to remain tepid for the next couple of months. Carriers are in a wait-and-see mode before adding trucks or replacing older units, thus OEM’s are adjusting their production to meet the lower demand and allow for inventory reduction at dealers.

BFL sales in the NA truck market declined by 47% compared to Q1 FY16 to Rs 1,269 million impacted by declining volumes & inventory de-stocking. The Passenger vehicle segment continues to show good growth across mass and premium vehicles and demand is expected to remain robust. BFL increased its market share in the Passenger Vehicle segment with an order win from existing client for traditional products.

Our constant focus on product diversification by leveraging our R&D capabilities has given our maiden order win from the North American market. We expect to build upon this order win in the coming quarters.

The European heavy truck market growth continues to develop positively mainly due to a high capacity utilization of the truck fleets, good demand for freight, customer profitability and the consequent fleet renewal. After a few volatile years since the 2008 financial crisis, the European passenger car market has started to show some momentum again and the growth in volumes is expected to continue but at a modest rate.

Industrial business

BFL Industrial business has interest spanning across commodities & allied sectors (Oil & Gas and

Construction & Mining), Transportation (Aerospace, Railways & Marine) and Energy (Renewable &

conventional Power). The business has been adversely impacted by the rapid decline & continued depressed prices in the Oil & Gas and allied sectors.

BFL had focused heavily on the Oil & Gas space and displayed tremendous results with revenues from O&G increasing rapidly from US$ 10 million to over US$ 100 million within a span of 4 years driven by successful development of highly value added critical components for shale.

Unfortunately, the convergence of anemic global growth over the past year causing weak consumption and lower cost of drilling due to emergence of new technology like fracking has led to excess supply in the market. This has led to crude prices declining by 80% and forcing companies to cut cost and put capital investment on hold in the sector. We have been impacted by this and our business in FY16 has declined by more than 50%.

We have started focusing on redeploying the assets, both human and capital which are fully fungible to address demand in Aerospace and Power sector (renewable & conventional). This strategy will allow the company to further diversify the industrial business and over time fill up the void left by the Oil & gas sector.

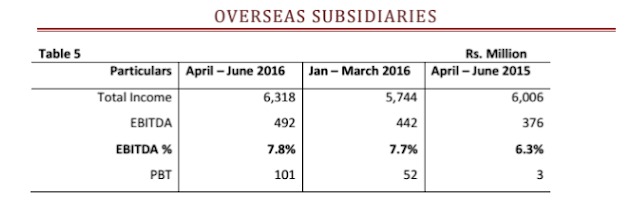

The subsidiaries continued to register strong performance with a 10% growth in topline driven by continued robustness in end market demand. EBITDA grew by 11.5% compared to the previous quarter while PBT almost doubled to Rs 101 million.